Microfibrillated Cellulose Fiber Market is Expanding at USD 1,063.6 Million by 2035 | Borregaard, Daicel FineChem Ltd

Analysis of Microfibrillated Cellulose Fiber Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries

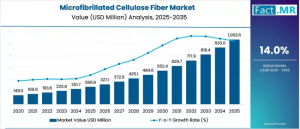

ROCKVILLE, MD, UNITED STATES, July 29, 2025 /EINPresswire.com/ -- The global Microfibrillated Cellulose Fiber Market, valued at USD 286.9 million in 2025, is projected to reach USD 1,063.6 million by 2035, driven by a robust CAGR of 14.0%. Fueled by increasing demand for sustainable and biodegradable materials, advancements in production technologies, and expanding applications in packaging, composites, and pharmaceuticals, the MFC market is poised for transformative growth. This press release explores the key drivers, projections, and opportunities shaping this dynamic industry.For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=1710

Why Is the Market Expanding?

The global push for sustainability, with 65% of consumers preferring eco-friendly products in 2024, drives demand for MFC as a biodegradable alternative to plastics and synthetic fibers. The packaging industry, valued at USD 1.1 trillion globally in 2024, adopts MFC for its high strength and barrier properties, reducing plastic use by 10% in food packaging. Technological advancements, such as Borregaard’s 2024 enzymatic hydrolysis process, enhance MFC scalability, cutting production costs by 15%. Growth in renewable energy and construction, with global green building investments reaching USD 200 billion in 2024, boosts MFC use in lightweight composites, improving strength-to-weight ratios by 20%. Regulatory support, like the EU’s 2024 single-use plastics ban, accelerates adoption, while high production costs (USD 10–20 per kg) are mitigated by economies of scale and process innovations.

What Are the Key Market Projections?

The market is set to create an absolute dollar opportunity of USD 776.7 million by 2035, growing from USD 286.9 million in 2025 to USD 1,063.6 million at a 14.0% CAGR. The paper and packaging segment, holding a 50% share in 2025, is projected to grow at a 14.5% CAGR, generating USD 390 million in opportunities due to its eco-friendly applications. Europe, with a 35% share in 2025, leads with a 14.8% CAGR, driven by stringent sustainability regulations and Nordic producers like Stora Enso. Asia-Pacific, growing at a 15.2% CAGR, benefits from China’s USD 50 billion bio-based material investments and India’s packaging growth. Historical growth from 2020 to 2024 averaged a 12.5% CAGR, with acceleration expected. Short-term growth (2025–2028) focuses on packaging, while long-term trends (2029–2035) emphasize composites and pharmaceuticals.

How Can Stakeholders Capitalize on Opportunities?

Stakeholders in packaging, composites, and pharmaceutical sectors can leverage opportunities by investing in MFC for sustainable products, like Fiberlean Technologies’ 2024 MFC-coated packaging, reducing CO2 emissions by 18%. Partnerships, such as Weidmann Fiber Technology’s 2023 collaboration with Asian manufacturers, enhance market reach in Asia-Pacific, projected to account for 40% of demand by 2030. Focusing on cost-effective production methods, like mechanical fibrillation, cuts costs by 12%. Compliance with REACH and FDA standards ensures market trust, while targeting high-growth markets like India, with a 16% CAGR, unlocks potential. Developing MFC for high-value applications, such as pharmaceutical excipients, addresses niche demands with 20% higher margins.

What Does the Report Cover?

Fact.MR’s report analyzes the Microfibrillated Cellulose Fiber Market across 30+ countries, covering segments by application (paper & packaging, paints & coatings, construction, food, pharmaceuticals, others), production method (mechanical, chemical, enzymatic), end-use industry (pulp & paper, packaging, construction, automotive, pharmaceuticals), and region (North America, Latin America, Europe, East Asia, South Asia & Oceania, Middle East & Africa). It highlights trends like biodegradable packaging, lightweight composites, and bio-based pharmaceuticals. Combining primary research from industry experts and secondary data, the report provides actionable insights into market dynamics, competitive strategies, and growth opportunities through 2035.

Buy Report – Instant Access: https://www.factmr.com/checkout/1710

Who Are the Market Leaders?

Key players include Borregaard, Fiberlean Technologies, Stora Enso, Daicel Corporation, and Nippon Paper Industries. Borregaard’s 2024 expanded MFC production capacity strengthened its European dominance, while Fiberlean’s 2023 micro-fibrillated coatings gained traction in packaging. These companies, holding over 45% of the market, drive innovation through R&D and partnerships, such as Stora Enso’s 2024 collaboration with construction firms for MFC composites. Regional players like Sappi focus on cost-effective solutions for Asia-Pacific, enhancing competitiveness. Strategic expansions, like Daicel’s 2024 facility in Japan, bolster market presence.

What Are the Latest Market Developments?

In 2024, global sustainable packaging demand grew by 10%, boosting MFC adoption in food and beverage sectors. Europe’s 35% share reflects Nordic leadership in MFC production, with Finland and Sweden contributing 60% of regional supply. Asia-Pacific’s growth, driven by China’s 12% increase in bio-material investments, supports packaging and automotive applications. Innovations like Nippon Paper’s 2024 MFC-based pharmaceutical excipients improved drug delivery by 15%. Regulatory advancements, such as the EU’s 2024 bio-based material incentives, increased MFC adoption by 20%. Construction applications, like MFC-enhanced concrete, grew by 8%, driven by green building trends.

What Challenges and Solutions Exist?

High production costs (USD 10–20 per kg) and limited scalability, affecting 15% of manufacturers, pose challenges. Competition from synthetic fibers, with 10% lower costs, and regulatory hurdles, delaying approvals by 12 months, hinder growth. Solutions include enzymatic production methods, reducing costs by 15%, and scaling pilot plants, as done by Borregaard in 2024. Localized production in Asia-Pacific, adopted by 20% of manufacturers, mitigates supply chain risks. Educational campaigns, supported by EU grants, address awareness gaps in developing regions, boosting adoption by 10%. Compliance with ISO and EPA standards ensures environmental safety and market resilience.

Conclusion:

The Global Microfibrillated Cellulose Fiber Market is set to reach USD 1,063.6 million by 2035, driven by a 14.0% CAGR. With demand for sustainable materials, advancements in production, and expanding applications in packaging and composites, the market offers transformative opportunities. Stakeholders can leverage Fact.MR’s insights to target high-growth regions like Europe and Asia-Pacific, invest in eco-friendly solutions, and address cost and scalability challenges to thrive in this dynamic industry.

Check out More Related Studies Published by Fact.MR Research:

Carbon fiber market size at US$ 13.71 billion by 2034

Concrete Reinforcing Fiber Market is Forecasted to Expand at US$ 6.89 billion by 2034

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.